PAYMENTS

Real-time feature computation

for payments

Chalk computes feature values at authorization time so models can evaluate risk using fresh, decision-time data.

TALK TO AN ENGINEER

For teams running payment models

Ship new authorization features fast

Introduce new features quickly and validate them against historical outcomes before they impact live authorization decisions.

Eliminate online and offline skew

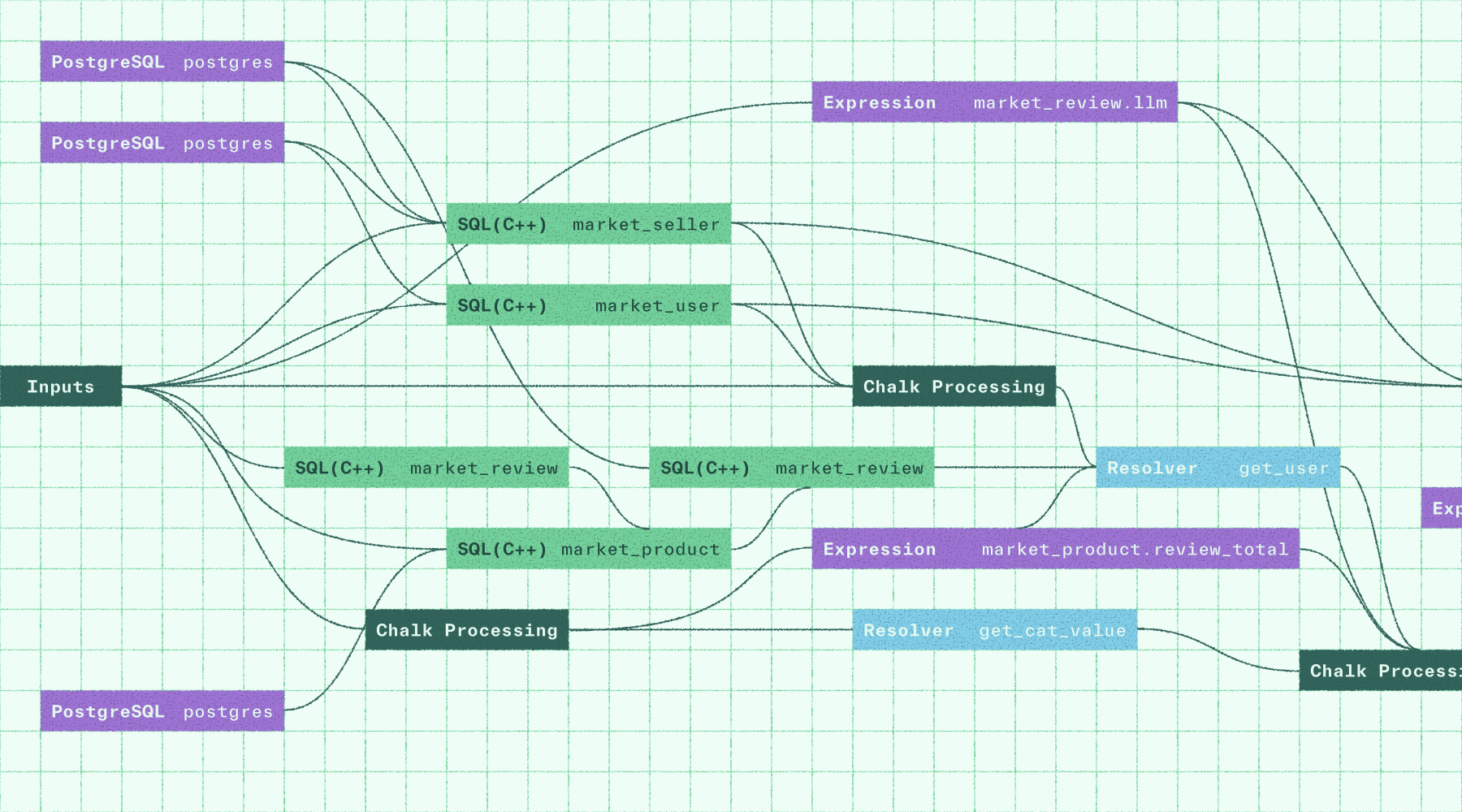

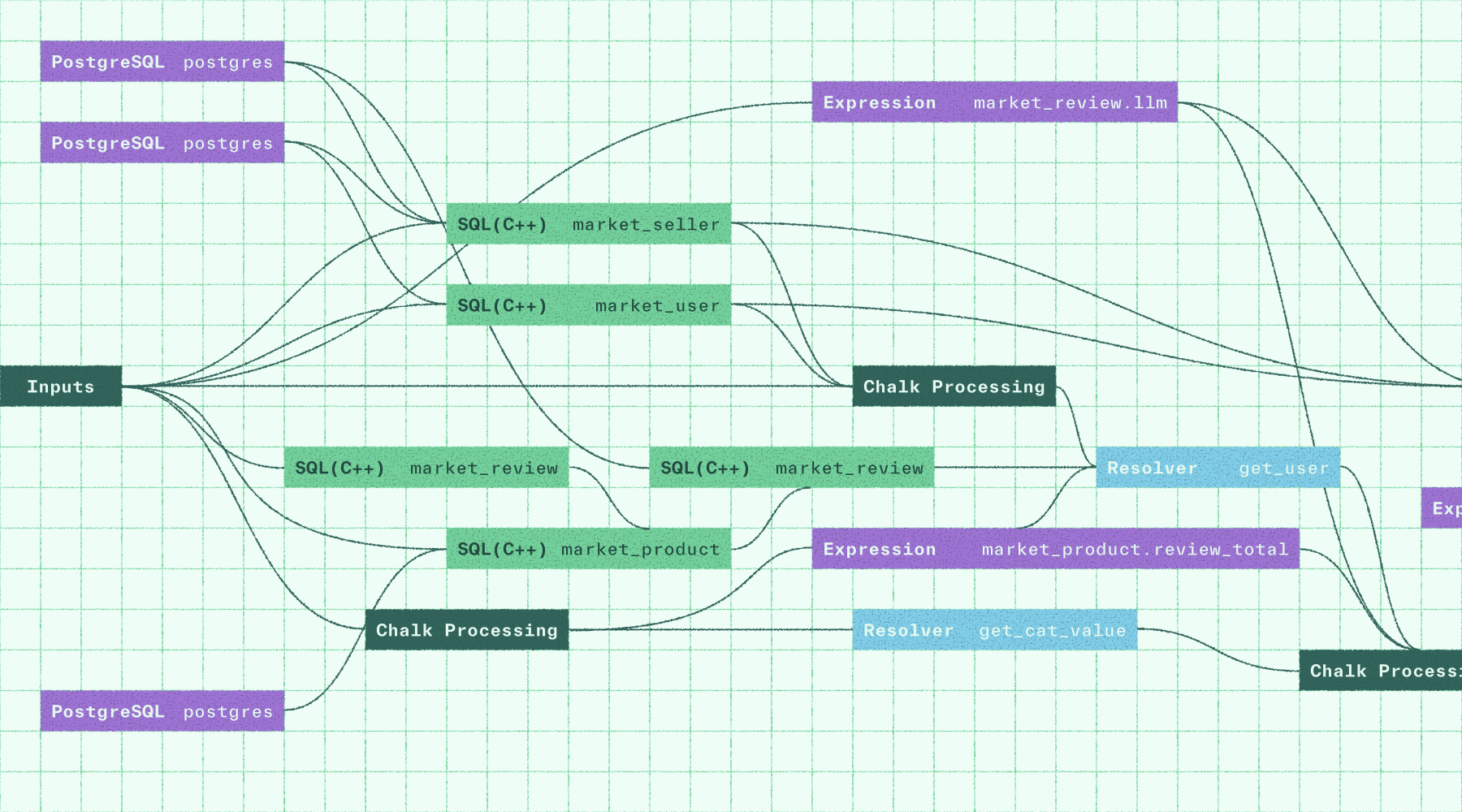

Reuse the same feature definitions for offline training and online inference to eliminate online-offline skew.

Inspect features

Inspect execution plans, data lineage, and computed feature values for every request.

Ship new authorization features fast

Introduce new features quickly and validate them against historical outcomes before they impact live authorization decisions.

Eliminate online and offline skew

Reuse the same feature definitions for offline training and online inference to eliminate online-offline skew.

Inspect features

Inspect execution plans, data lineage, and computed feature values for every request.

Power real-time payment decisions

Reduce latency and stale features. Power models with fresh signals at inference time.

Reduce fraud losses without increasing false declines

Serve fresh features to improve model accuracy while maintaining high approval rates and a smooth customer experience.

Seamless compliance

Monitor outputs with full observability, built-in lineage, audit logs, tracing, and PII masking.

Chalk helps us deliver financial products that are more responsive, more personalized, and more secure for millions of users. It’s a direct line from infrastructure to impact.

Meng Xin Loh Technical Product Manager

Detect anomalous spend and transaction

patterns at authorization time.

Compute features at decision time to evaluate spend behavior and velocity signals.

Score risk in the most latency-sensitive

moment of the payment flow.

Compute hundreds of fraud features per transaction in single digit milliseconds at p99 latency, powering real-time authorization decisions at scale.

Identify coordinated abuse

across transactions.

Compute rolling and historical aggregations on demand to detect patterns.

Adapt quickly as

fraud patterns change.

Backtest new features and deploy the same feature definitions to production without rebuilding pipelines.

Built and proven in

global payment systems

Power real-time fraud systems where hundreds of feature values must be computed per decision under strict latency, reliability, and compliance constraints. Teams use Chalk to support authorization-time decisioning while maintaining consistency between offline validation and production behavior.

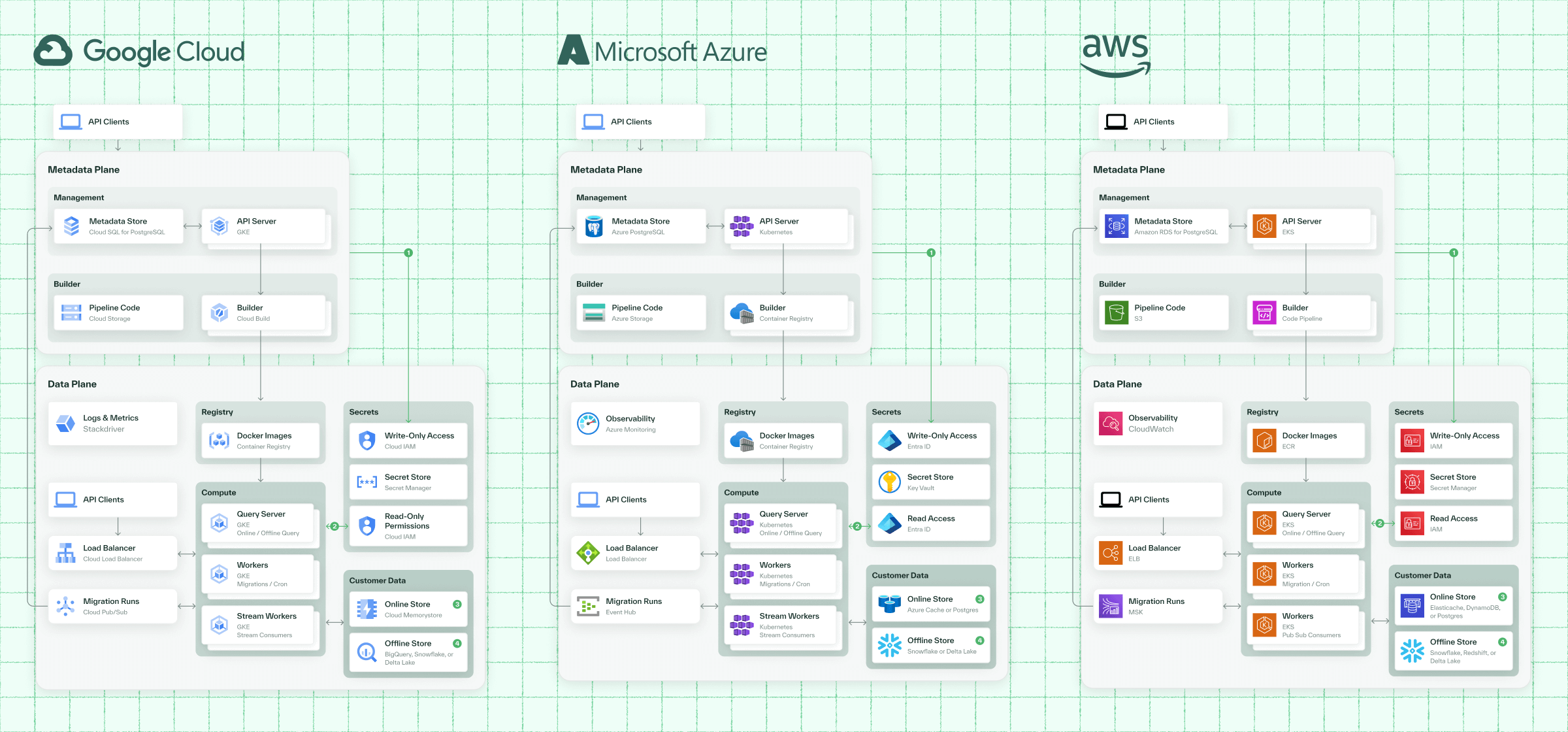

Real-time servingEnterprise-grade security

Chalk deploys within your cloud. All feature computation runs alongside your data sources, enabling data residency, compliance, and integration with your IAM and networking controls.

Deploy in your cloudShip better fraud decisions

without risking approvals

Ship better fraud decisions

without risking approvals

By unifying offline and online computation, teams iterate faster, eliminate online/offline skew, and operate fraud systems that continuously improve without added infrastructure complexity.

More resources

Build payment fraud systems for the moment decisions matter

Use Chalk to define, compute, and serve fraud features at authorization time. Move faster, reduce risk, and maintain control as fraud patterns evolve.

TALK TO AN ENGINEER